CRDB Bank Formalizes Strategic Partnership with Japan's Sumitomo Mitsui Banking Corporation

By: Nimrod Ambrose | Blog | August 21, 2025 22:29

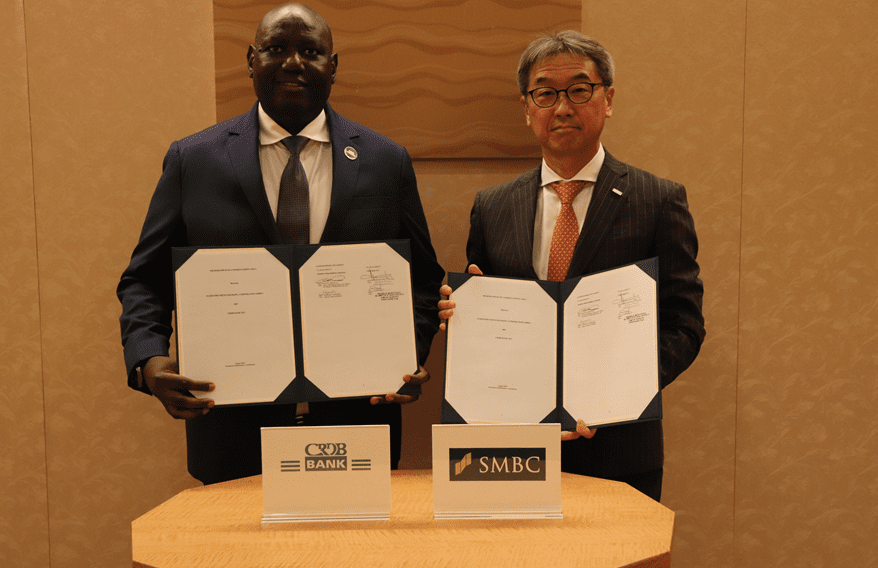

Yokohama, Japan – August 21, 2025 – We at CRDB Bank PLC are excited to announce a historic milestone: the signing of a Memorandum of Understanding (MOU) with Sumitomo Mitsui Banking Corporation (SMBC) of Japan. This pivotal partnership was formalized today during the 9th Tokyo International Conference on African Development (TICAD9) in Yokohama, Japan. This collaboration is a major step forward for us and for the financial sector in Tanzania. The agreement was signed by our Chief Commercial Officer, Mr. Boma Raballa, and SMBC's President and CEO, Mr. Akihiro Fukutome. It is designed to significantly enhance our services in key areas including cash management, trade finance, transaction-related aspects, syndication, and treasury-related products. By working with a global leader like SMBC, we are strengthening our ability to provide our customers with world-class financial solutions that will help them grow their businesses and contribute to Tanzania’s economic development. CRDB Bank has always been committed to empowering individuals and businesses, and this new partnership is a testament to that commitment. With our extensive network of branches and digital channels, we are strategically positioned to leverage SMBC’s global expertise to deliver even greater value to our customers. We look forward to a successful collaboration that will create new opportunities and drive sustainable growth for our communities and the wider East African region.

Related

BLOG

Syndication

There are opportunities to collaborate on syndication projects that strengthen financial capacity an...

Read More

BLOG

Capacity Building

We welcome partners to join us in strengthening the skills and capacity of both staff and customers,...

Read More

BLOG

Funding, Investment & Guarantee

We collaborate with partners to expand access to finance and unlock growth across key sectors includ...

Read More