Innovation & Technology for Communities

By: Nimrod Ambrose | Blog | July 20, 2022 21:57

Dar es Salaam, 20 July 2022 – As part of its ongoing efforts to support entrepreneurs in the country, CRDB Bank today signed a loan agreement worth a total of USD 60 million with the African Development Bank (AFDB).

Under this agreement with AFDB, CRDB Bank will allocate USD 50 million to strengthen its capital base and support the bank’s regional expansion plans. The remaining USD 10 million of the loan will be directed towards enhancing access to finance for small and medium-sized enterprises (SMEs) in Tanzania.

The agreement also includes technical assistance and training worth USD 175,000 to enhance CRDB Bank’s capacity to support women entrepreneurs in Tanzania, making them more bankable.

Additionally, the African Guarantee Fund (AGF) has enhanced its guarantee facility to USD 50 million for CRDB Bank to support entrepreneurs in the country. The facility includes a special AFAWA Growth Guarantee to reduce market risk for women entrepreneurs and further accelerate their growth. The AFAWA Growth Guarantee is part of AFDB's initiative, which aims to unlock up to USD 5 billion for women-owned businesses by 2026.

Signed by Nnenna Nwabufo, AFDB Director General for East Africa, Jules Ngankam, CEO of the African Guarantee Fund, and Abdulmajid Nsekela, CEO of CRDB Bank, this empowerment agreement significantly boosts CRDB Bank's capacity to finance entrepreneurs, especially women, and unlock their full potential.

Speaking at the event, AGF CEO Jules Ngankam thanked CRDB Bank for its long-standing partnership with AGF, which has supported entrepreneurs across various sectors in Tanzania. "I believe this tripartite partnership between CRDB Bank, AFDB, and AGF will yield even greater positive outcomes, especially in closing the financing gap for women-owned businesses," he said.

AFDB East Africa Director General Nnenna Nwabufo noted that the partnership will enable entrepreneurs to access the financing needed to grow and improve their businesses. More importantly, it strengthens Tanzania’s efforts to close the USD 1.6 billion financing gap for women entrepreneurs.

“We are pleased to finalize these agreements. The USD 50 million loan from AFDB will strengthen the bank’s capital base, support the implementation of CRDB Bank's strategic plans, and facilitate regional expansion without compromising capital ratios. I would like to thank our partners, AFDB and AGF, for their continued support,” said Abdulmajid Nsekela, CRDB Bank’s CEO. The bank is currently finalizing its entry into the DRC market and considering expansion into other markets within East and Central Africa.

Nsekela also emphasized that the agreements with AFDB and AGF align with CRDB Bank’s commitment to empowering entrepreneurs in the country through affordable financing. "The USD 10 million loan and USD 50 million guarantee will enhance our ability to support more women-owned businesses through our ‘Women Access to Finance (WAFI)’ program, implemented under the CRDB Malkia initiative," he added.

Related

BLOG

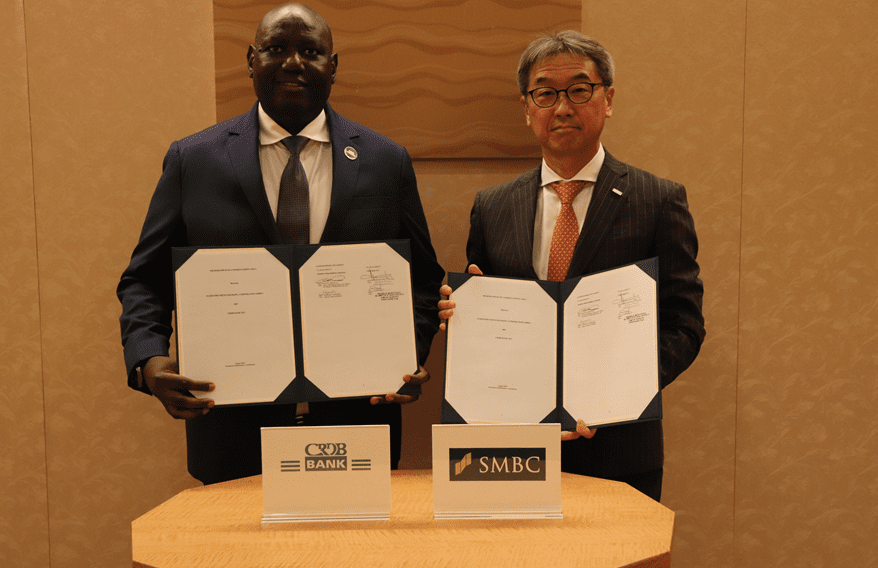

CRDB Bank Formalizes Strategic Partnership with Japan's Sumitomo Mitsui Banking Corporation

Yokohama, Japan – August 21, 2025 – We at CRDB Bank PLC are excited to announce a historic milestone...

Read More

BLOG

Syndication

There are opportunities to collaborate on syndication projects that strengthen financial capacity an...

Read More

BLOG

Capacity Building

We welcome partners to join us in strengthening the skills and capacity of both staff and customers,...

Read More